Health Insurance Plans: What Are Your Options?

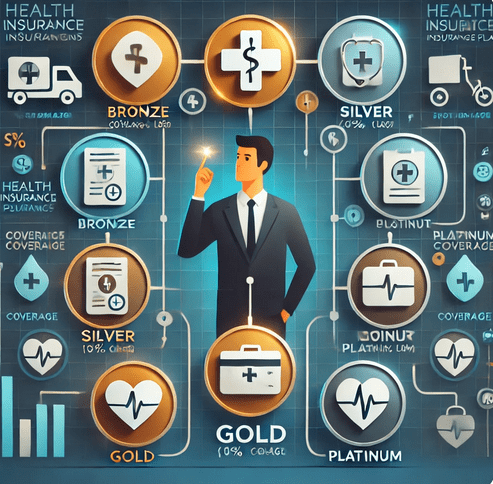

This means that when you are getting a health insurance, you will have to get a lot of options which you’ll have to take. Health plans are tiered by the benefits they provide as known as bronze, silver, gold, and platinum before getting through your state’s marketplace or an insurance broker. Copper plan has the lowest premium with little coverage, while Gold plans has the highest premium with full coverage. If you are below 30 years then you may use the provision of having a high-deductible, catastrophic plan.

Most of the time when people are grappling with health problems, they don’t bother to understand the difference between different health plans.

Every health plan maintains a pre-stipulated proportion of average member healthcare expenses which it covers. However, other factors like deductibles that means the cash that you would have to deposit before the plan starts paying your medical bills are always different. It is conventional that those that cost the least entail the highest deductibles as well. All plans have the same out of pocket limit as the chosen plan for 2024 ($9,450). After cumulative payment of this amount in copayments, coinsurance, and deductibles, the plan assumes 100 % of the qualifying medical bills.

• Platinum: Pay 10% and the insurance pays 90% of your medical expenses.

• Gold: It even pays 80% of your medical costs, while you contribute 20%.

• Silver: you fund 70% of it and the medical insurance covers 30% of it.

• Bronze: It meets 60 percent of your medical bills, and you contribute 40 percent.

• Catastrophic: Catastrophic plans pay for everything from point where you have paid your high plan ($9,450 in 2024). It also covers, three primary care visits for free and preventive care services regardless of the deductible beforehand.

Major Insurance Brands

Some of the health insurance brands that offer such plans are; Aetna, Blue Cross Blue Shield, Cigna, Humana, Kaiser and UnitedHealthcare.• Preferred Provider Organizations (PPOs)• PPO stands for Preferred Provider Organizations• Exclusive Provider Organizations (EPOs).• Point of Service (POS) Plans• Health Maintenance Organizations (HMOs) which are sometimes combined with preferred provider organizations and/or point of service plansue Cross Blue Shield, Cigna, Humana, Kaiser, and UnitedHealthcare. Each of these brands offers different plan types, such as:

• Health Maintenance Organizations (HMOs)

• Preferred Provider Organizations (PPOs)

• Exclusive Provider Organizations (EPOs)

• Point-of-Service (POS) Plans

• High-Deductible Health Plans (HDHPs), which are sometimes linked to Health Savings Accounts (HSAs)

Knowledge of the distinctions between each of these plans will assist you in deciding which is perfect for you and your pocket.

Health Maintenance Organization (HMO)

Health maintenance organisation HMOoptional concept of health care delivery where all the services are provided by a network of healthcare providers and facilities.• Owing to the competitively lower rates offered, there is limited to no freedom of selecting providers.• Little documentation and huge process integration. Also referred to as a general practitioner, he is a doctor who supervises your case then recommend a specialist to attend to you.f healthcare providers and facilities. With an HMO, you have:

• Less freedom to choose your providers compared to other plans.

• Minimal paperwork and streamlined processes.

• A primary care doctor who manages your care and refers you to specialists as needed. If you want to be seen by a specialist, you usually must get a referral or else your insurance does apply.

Provider Network: Plans restrict you from accessing any doctor or healthcare provider of your choice except in an emergency. It is normally provided considerably and does not recognize out-of-network care.

Costs:

• Premium: The amount you pay on the insurance each month.

• Deductible: Certain HMOs allow you to incur out-of pocket expenses before the plan pays for care other than preventive services.

• Copays/Coinsurance: You’re charged a fixed amount (copay) or a proportion (coinsurance) of the costs of the care, which apply toward your deductible.

PPO stands for Preferred Provider Organization

PPOs provide higher freedom of choice; the patient can visit any specialist without getting a referral from a primary care doctor.• Greater choice of healthcare providers than in the case of an HMO.• Higher rates of insurance premiums to see doctors not from the particular network.• No claims for in-network care but you will need to submit claims if you are seeing an out of network provider.without needing referrals for specialists. With a PPO, you get:

• More freedom to select healthcare providers compared to an HMO.

• Higher out-of-pocket costs for seeing out-of-network doctors.

• Less paperwork for in-network care, but you’ll need to file claims for out-of-network care.

Provider Network: Anyone may visit any PPO plan doctor or out of PPO network providers at a higher amount.

Costs:

• Premium: Insurance premium car pay in a month.

• Deductible: Some PPOs may require the policy-holder to pay a certain amount of money before getting covered and this will be more expensive for out of network facilities.

• Copay/Coinsurance: The choice you are offered is to pay a fixed sum of money or a percent of it for care and the prices can differ depending on the type of provider – in or out of network.

An Exclusive Provider Organisation (EPO)

An EPO is a kind of health plan that is intermediate between an HMO and a PPO; it can be a bit more of free-for-all than an HMO but restricted in out-of-network provision.• No requirement of referral to see the specialists.• Little to no out-of-network benefits (a limited position)।• Higher out-of-pocket costs than PPO plans with the same insurers.ound between an HMO and a PPO, offering some flexibility but limiting out-of-network care.

• No referrals needed to see specialists.

• No coverage for out-of-network providers (except in emergencies).

• Lower premiums compared to PPO plans from the same insurer.

Provider Network: It is important to understand that you can only see doctors that are part of the EPO’s list of approved physicians.

Costs:

• Premium: Monthly cost for insurance.

• Deductible: Some EPOs have deductibles.

• Copay/Coinsurance: Some are charged on a flat fee basis while others attract a percentage fee for each service.

Point-of-Service Plan (POS)

More freedom in selecting the providers of care as compared to HMO.• Slightly higher paperwork for services from out of network providers.• A team leader of your primary care clinician, specialist who will provide specialized care and recommend other doctors to attend to you.

• More freedom to choose providers than with an HMO.

• Moderate paperwork for out-of-network care.

• A primary care doctor who coordinates your care and gives referrals to specialists.

Provider Network: You can go for those providers on the network with a referral or pay more cash for out-of-network services.

Costs:

• Premium: The common term insurance premium payable in the market.

• Deductible: In some cases, the policyholder is required to make some payments out of his or her pocket before the insurance provider contributes in equal measure. In most cases, out-of-network services are often characterized by a higher level of deductible.

• Copay/Coinsurance: Common examples for copayments or coinsurance amounts exist, and patients face higher out of pocket expenses for out of network care.

Catastrophic Health Plan

If you are below thirty years, you can get a catastrophic health plan.• Add three free primary care visits to before the deductible is applied to the policy.• Any type of preventive care needs to be provided free of charge even if the insured hasn’t met the specified deductible.tastrophic health plan. These plans:

• Offer low premiums.

• Include three free primary care visits before the deductible applies.

• Provide free preventive care, even if you haven’t met the deductible.

Costs:

• Premium: Premium to be paid in terms of insurance policy.

• Deductible: The deductible is $9,450 for individuals in 2024. After paying the stipulated amount towards your health as the deductible, the plan pays for all your eligible medical expenses.

High-Deductible Health Plan (HDHP) with Health Savings Account (HSA)

An HDHP offers lower premiums but higher deductibles, which can be paired with a Health Savings Account (HSA). With an HDHP, you get:

- Lower premiums compared to other plans.

- The option to open an HSA, where contributions are tax-free and can be used for eligible medical expenses.

Costs:

- Premium: Lower than traditional plans.

- Deductible: The minimum deductible is $1,500 for individuals and $3,000 for families, with an out-of-pocket maximum of $8,050 (individual) and $16,100 (family) in 2024.

- Copay/Coinsurance: Once you meet the deductible, the plan pays 100% of your care costs for covered services.